Our Story

25 years ago

How it all started

Twenty-five years ago, I started my wealth management career at one of the largest financial institutions in the country - BMO Financial Group. At age 33, I became the Director of Private Wealth Planning at one of Canada’s leading private banks - thanks to God’s will and my mother’s prayers.

Catalyst for change

I remember standing in my office, on the 51st floor at First Canadian Place, when I realized that the client promise spoken of in bank marketing material was largely aspirationaI. This realization caused a core values misalignment within me. Not to say that the big six banks are bad - quite the contrary. A lot of good people work at the banks and our country needs a stable banking system.

When one door closes, another opens.

My departure from the bank led me to open the doors at PANGEA. I founded PANGEA to help global families flourish for generations.

“I founded PANGEA to help global families flourish for generations.”

— Declan Winston Ramsaran, Founder, PANGEA Private Wealth

The BIG vision

Clients first

It may sound like a radical idea, but I actually thought it was possible to build a client-centric service model that put clients’ best interests, first. The way I saw it, wealth included more than dollars & decimals.

I built, what I believe to be, a sustainable client-centric process that I called our Family Circle of Wealth. It’s a 5 phase approach to the wealth conversation that considers a 360 degree view of family wealthcare.

It worked

Clients loved it. But there were birth pains in the beginning. As with every business, storms arose over the years to test the service model as well as the company. PANGEA forged ahead with resilience. When I founded PANGEA, the vision was never to become the largest company on the planet by number of employees or the biggest in terms of revenue. My vision is for PANGEA to tower amongst the longest standing companies on the planet. Our first decade of operation is almost over as we prepare to stride into the second decade of our thousand year future.

“The way I see it, wealth includes more than dollars & decimals.”

— Declan Winston Ramsaran, Founder, PANGEA Private Wealth

Our 5 core beliefs

Why we do what we do

1

We help create more time for you and your family

We believe that in many ways, time is more valuable than money and that you likely prefer to dedicate your limited time to enjoy things that matter most to you.

2

We help reduce your worry about family wealth matters

We believe that what families are really looking for, is a long-term relationship with a team they trust who knows them best and always puts them first.

3

We help enrich your quality of life

We believe that your golden years are those when you are healthy, full of vitality, experiencing personal growth and present in the lives of the people you care about most.

4

We support your aspirations

We believe that wealth transcends dollars and decimals to include the human elements of personal well-being, family intellectual capital and family & community legacy.

5

We help simplify your whole life

We believe that a family wealth strategy should consider both the quantitative and qualitative elements of family life supported by a team commanding mastery in various disciplines.

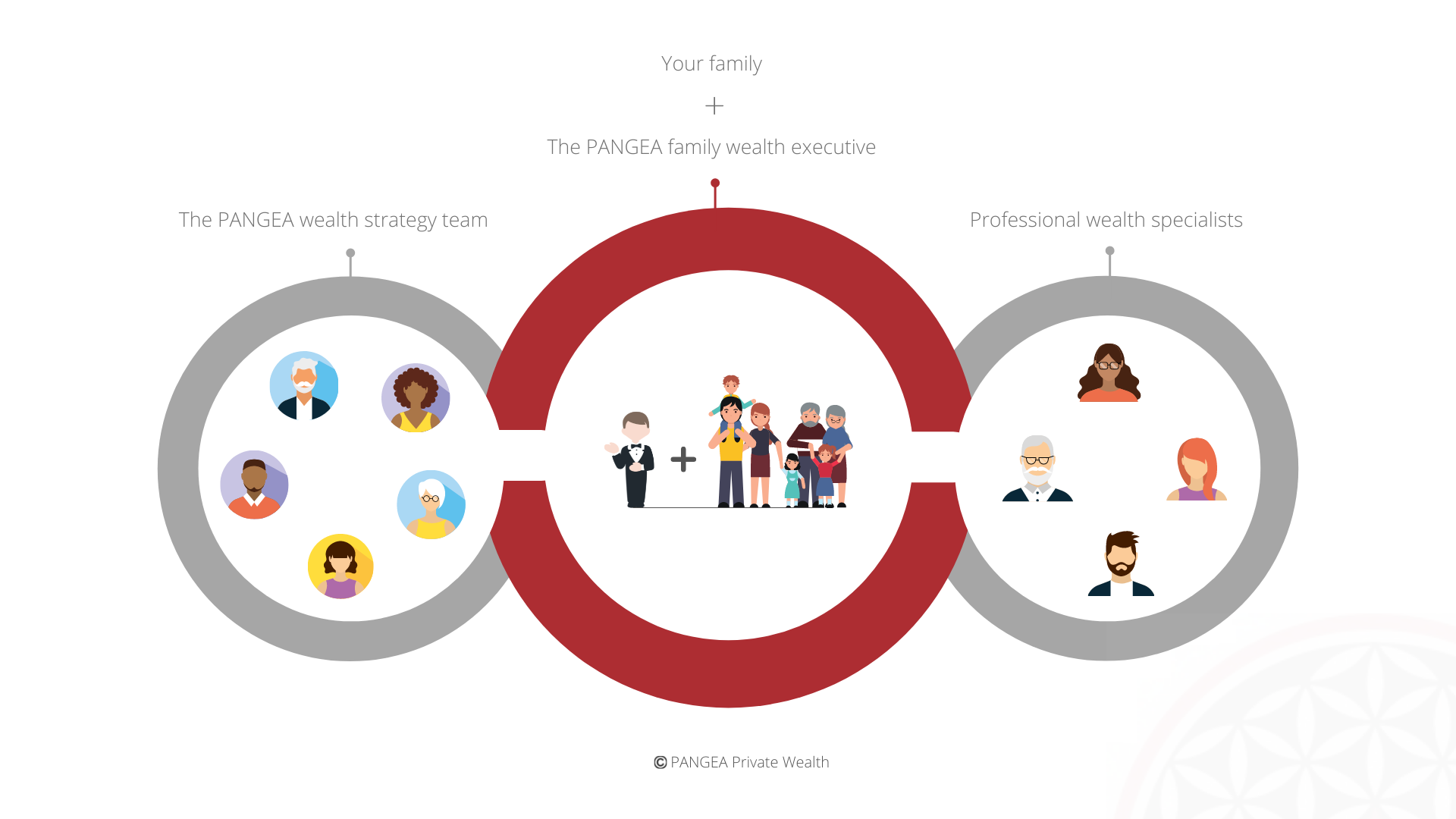

Our professional team

The Family Wealth Executive

As a PANGEA client, your single point of contact is your Family Wealth Executive. This person is responsible for your successful, long-term relationship with us. They oversee all relevant aspects of your family wealth plan while remaining in regular contact with you.

Your Wealth Strategy Team

No one person can do it all. Most clients choose to partner with us because they outgrew their previous advisor. Our approach to the wealth conversation ensures that you get knowledgeable advice from a team of subject matter experts including LLBs, CPAs, CFAs, CFPs et. al.

Professional Wealth Specialists

Your family doctor is likely a general practitioner (GP). GPs treat common medical conditions and refer patients to hospitals for specialist treatment. A cardiologist is an example of a medical specialist. Some examples of professional wealth specialists include: Chartered Business Valuators, Individual Pension Plan Specialists and Capital Markets Specialists.

What our clients say

“Before engaging PANGEA, my wife and I worked with financial advisors who represented some of the biggest financial services companies in the country.

We talked to PANGEA about what we thought was missing for us in those advisor relationships and learned about how their process was different. I have to say that since our family chose to partner with PANGEA we haven't looked back. Declan and his team bring vast financial knowledge and a methodical approach to helping us articulate our financial and life goals as a family. We haven't experienced a process like this before - it was a very fulfilling exercise. We are pleased with the progress and look forward to growing our relationship.

We aren't just business partners, our families have become good friends that share similar aspirations in life. Our meetings sometimes take place around our family dinner table - and that's something special to us.”

- Robert & Brenda A., Oakville, ON

Contact us.

Use this contact form for any of the following reasons:

Media inquiries/interview requests for PANGEA

Requests for more information on PANGEA

Client service requests for PANGEA